Considering that 80% of European nonprofits face massive challenges in gift processing and reporting, it’s hard not to see a link between unclaimed Gift Aid and difficulties in managing donors and processing Gift Aid declarations.

So how can you make the most out of Gift Aid? And how do you claim all that missing income for your charity?

Three tips for maximizing your Gift Aid opportunity

Be transparent and make Gift Aid visible

Gift Aid declarations don’t require much information. You only need your donor’s name and house address, or even the house number and postcode. If you have this information you’ll have enough information to complete a Gift Aid declaration, ready to be sent to the HMRC.

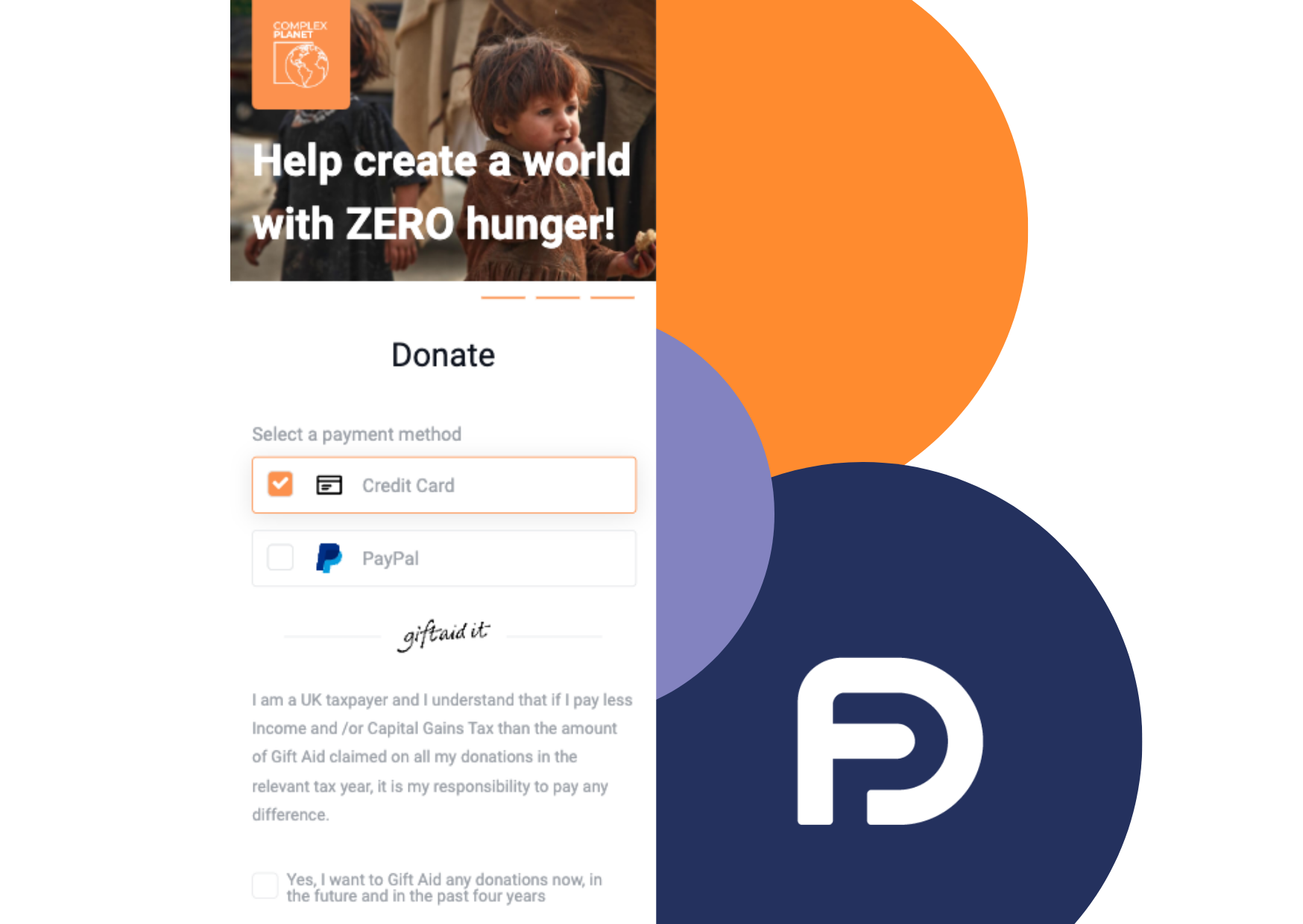

At FinDock, we want to make it as easy as possible for charities to claim Gift Aid, and so with Giving Pages, our donation page, and form builder you can easily add info about Gift Aid along with a Gift Aid checkbox. That means that when someone makes a donation and checks the box, FinDock picks it up automatically and sends the claims to the HMRC for processing with almost no effort on your part.

You can easily add Gift Aid to Giving Pages

Claim Gift Aid retroactively

The first step is to identify which donors don’t have a Gift Aid declaration on file — with FinDock, you can simply apply a filter and sort through your donors. Then, you can either contact them personally or send an email prompting them to complete their Gift Aid declaration (you might also couple this with another prompt – like a donation or an engagement event.

And then when you have all the declarations, you can submit these to HMRC for approval to collect the uncollected income.

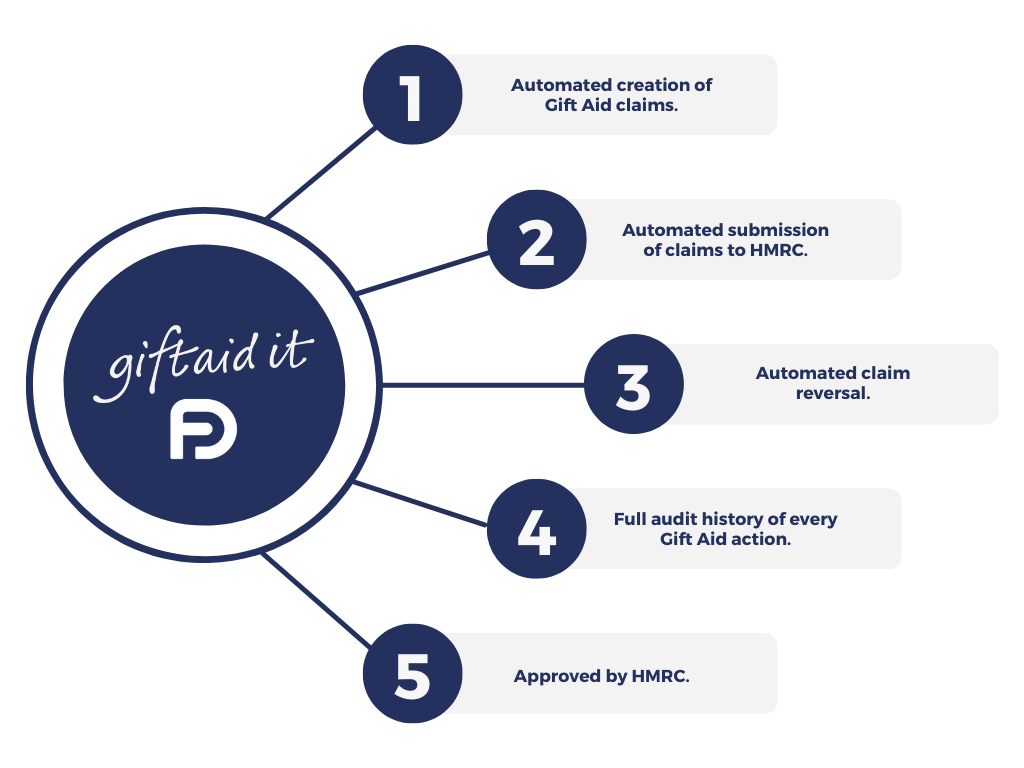

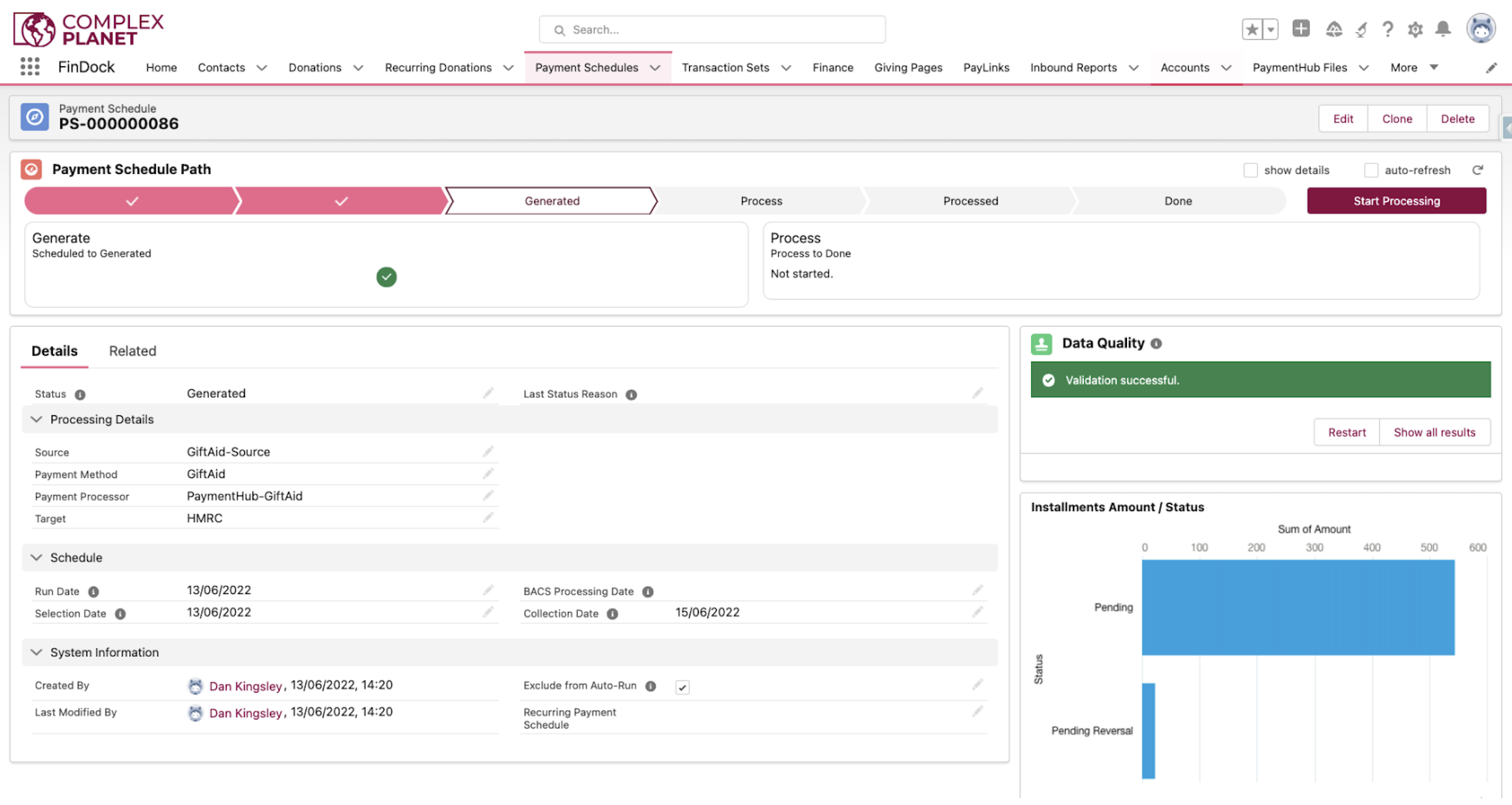

FinDock lets you automate GiftAid claims directly from Salesforce

Automate Gift Aid processing

If you use FinDock to manage your donation processing, you can fully automate the Gift Aid process from Salesforce. That means, whenever you capture a donation and Gift Aid declaration, all the information is added to your Salesforce CRM and also automatically sent to the HMRC on whatever schedule matches your charity’s operations. This is a huge time-saver for charities, saving some of our customers a few days a month.

With FinDock, you can automate Gift Aid and save a considerable amount of time

Dan Kingsley

Director, Nonprofit Industry Solutions

Dan is FinDock’s Nonprofit Industry Solutions Director. After 12 years of working as Head of Fundraising & Supporter Operations for a large UK-based debt counseling charity, he gained enough insight to be able to help more charities by creating and implementing modern solutions that save time and money.