Welcome to FinDock

The world of Customer Payment Happiness

If payments aren’t part of your CRM, you’re missing a vital connection to your customers. Payments are more than a transaction. They’re opportunities to strengthen relationships, boost loyalty, and spark growth. By integrating payments, you gain real-time insights that fuel your entire customer journey, from personalized marketing to efficient customer service.

Trusted by 300+ companies from nonprofit to enterprise

Why payments belong in your CRM

If payments aren’t part of your CRM, you’re missing a vital connection to your customers. Payments are more than a transaction. They’re opportunities to strengthen relationships, boost loyalty, and spark growth. By integrating payments, you gain real-time insights that fuel your entire customer journey, from personalized marketing to efficient customer service.

What we do

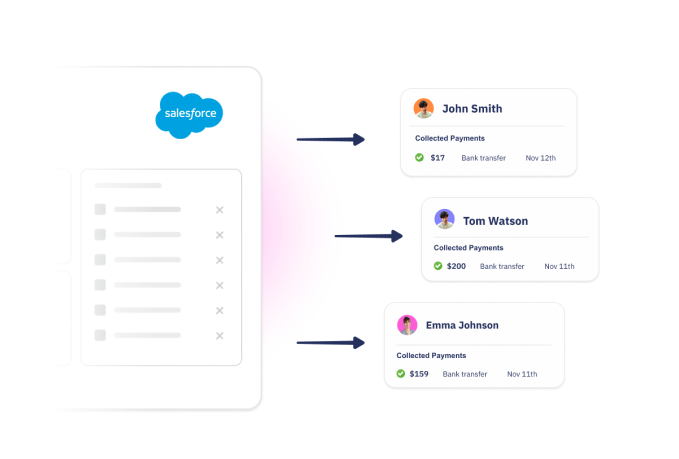

FinDock places payments at the core of Salesforce, transforming your CRM into a powerful engine for customer interactions. With seamless integration, you access real-time payment data that drives personalization. Whether it’s crafting targeted marketing campaigns or resolving payment issues quickly.

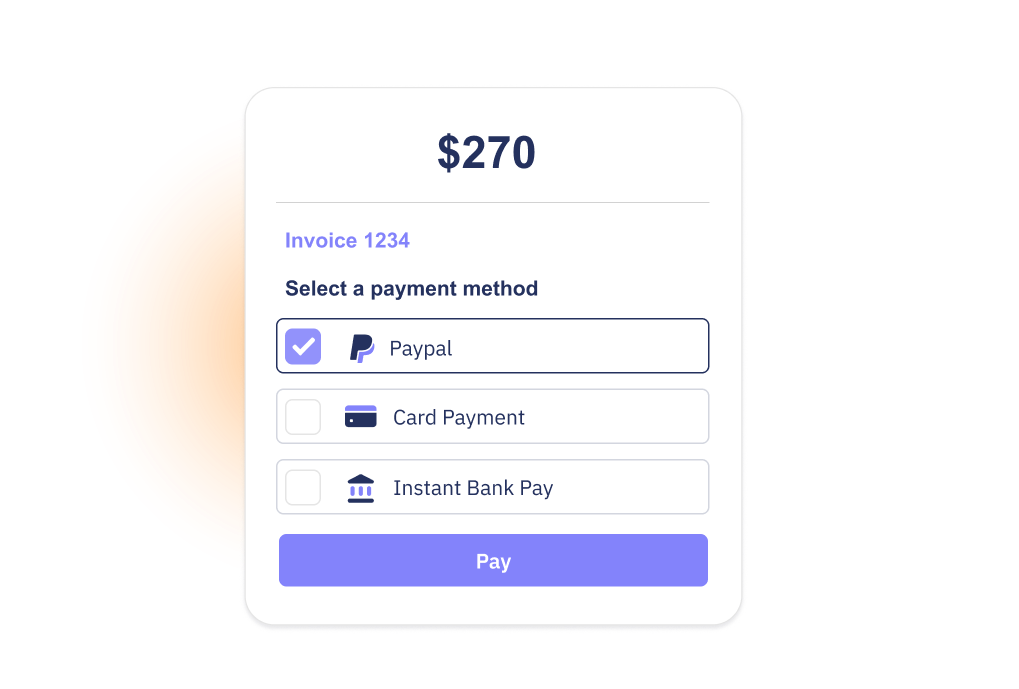

Accept payments

- Create & launch Payment Pages in Salesforce

- Access powerful Payments API

- Create and send payment requests or payment links from Salesforce

- Offer a range of payment options, including Direct Debit, Credit Card, and online methods like iDEAL, Bancontact, Sofort, and many more

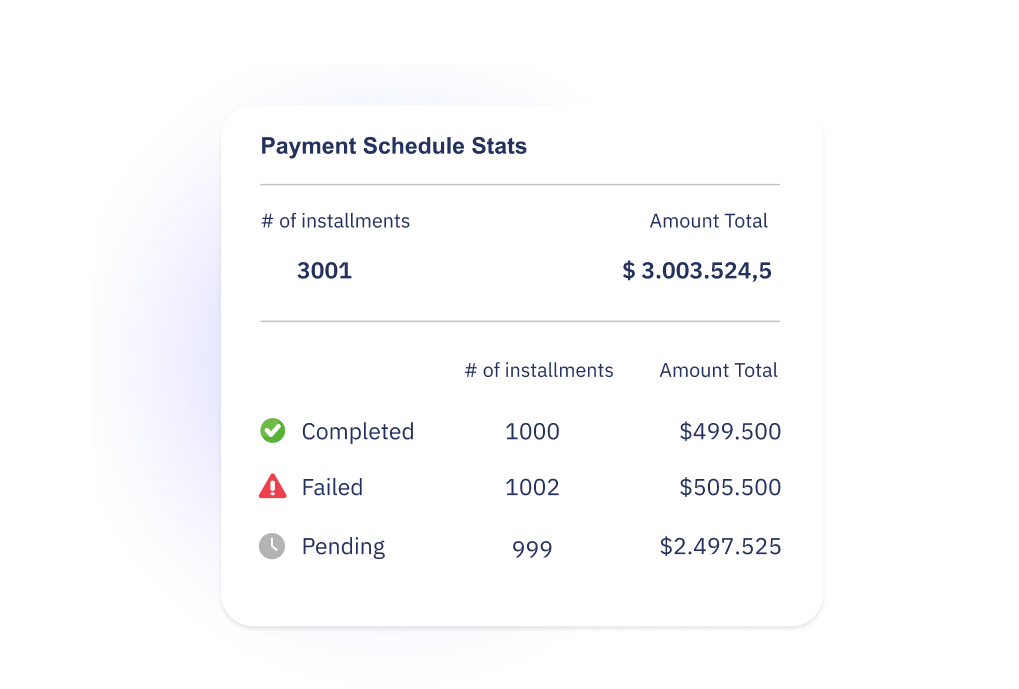

Process payments

- Connect to payment processors and banks in Salesforce

- Create bank collection files

- Process and automate one-time and recurring payments

- Manage direct debit collection natively in Salesforce

Reconcile payments

- Import bank files and reconcile with CRM data

- Automatically reconcile payments through payment service providers

- Customise matching rules to align to your needs

- Manually matching where required

FinDock supports a wide range of international and local payment methods and processors across Europe, the UK, and the US. For a complete overview of compatible payment solutions, please refer to our factsheet.

The FinDock advantage:

every department thrives

When payments are embedded into Salesforce, it creates a spiral of success that benefits every part of your organization.

We work with all Salesforce Clouds and Industries

Placing payments in the heart of Salesforce allows insurers to align policy management with service and support, improving efficiency and customer satisfaction.

Centralized payments: manage premium payments directly in Salesforce, uniting your service, sales, and marketing teams around customer data.

Recurring premiums, on track: automate recurring premium payments and track every interaction, from sales to support.

Payment choices: offer policyholders multiple payment options—cards, bank transfers, or Direct Debits.

Automated reminders: no more chasing missed payments—automated follow-ups keep premiums up-to-date.

Policy insights in real-time: integrate payments with customer data for a complete view that boosts upsell opportunities and customer loyalty.

FinDock in Salesforce centralizes membership payments, creating a more cohesive experience across marketing, service, and support teams.

Streamlined payments: automate membership fees and link payment data with Salesforce to provide a seamless experience across service, marketing, and support.

Flexible payment options: members choose how they pay—cards, bank transfers, or Direct Debits.

Membership upgrades, simplified: handle one-time payments for upgrades or adjustments in seconds, linked to your member data in Salesforce.

Better retention: use payment insights to improve member engagement and personalize offers, increasing loyalty.

Automated payment reminders: missed fees? No problem—automated reminders ensure you stay on top of membership renewals.

With FinDock, integrating payments in Salesforce doesn’t just make donations easier, it also streamlines your marketing, service, and engagement efforts, leading to more effective fundraising.

One platform, all donations: centralize donor payments and data in Salesforce, linking marketing, service, and engagement for a better donor experience.

Recurring donations, simplified: automate recurring donations for increased donor loyalty, without the manual follow-up.

Payment flexibility: let donors choose how they give—cards, bank transfers, Direct Debits—it’s their call.

Real-time insights: use payment data to optimize donor journeys across your entire organization.

Automated follow-ups: never miss a donation with built-in reminders for failed payments, ensuring continued support.

Education

Streamline tuition management and create a better experience for students and staff.

Payments in Salesforce help educational institutions align student onboarding, support, and marketing for a better overall experience.

One system, every payment: centralize tuition and fees in Salesforce, aligning finance, student services, and marketing teams.

Recurring tuition, handled: automate tuition payments, so students (and staff) have one less thing to worry about.

Flexible payment options: students choose their payment method—cards, Direct Debits, or digital wallets.

Smart payment tracking: payment data connects seamlessly with student profiles, enabling better engagement and retention strategies.

Automated follow-ups: missed payments? Built-in reminders handle it, reducing manual workload and improving cash flow.

With FinDock in Salesforce, energy companies can link payments, support, and customer engagement to streamline processes and boost loyalty.

One system, all payments: Manage recurring utility payments for electricity, gas, and water, centralizing data for finance, service, and marketing teams.

Automate recurring payments: Keep the lights on—automate utility bill payments, ensuring smooth transactions every billing cycle.

Flexible payment channels: Let customers choose how they pay—Direct Debits, cards, or bank transfers.

Service-linked payment data: Integrate payments with customer service requests, making issue resolution faster and more efficient.

Automated follow-ups: Missed a payment? Automated reminders keep bills up to date, reducing manual effort.

Placing payments within Salesforce for communication services ensures seamless coordination between sales, service, and marketing teams.

Centralized billing: automate subscription payments for mobile, internet, and communication services in Salesforce, linking finance, service, and sales.

Recurring payments, handled: ensure seamless, recurring payments for uninterrupted services, improving customer satisfaction.

Flexible payment options: customers choose their method—cards, Direct Debits, or digital wallets—making payments easier for everyone.

Better customer engagement: payment data connects with service and marketing, enabling personalized interactions and reducing churn.

Housing

Simplified rent payments that connect your tenant relationships with marketing, service, and finance.

Housing organizations can streamline payments and improve tenant engagement by integrating FinDock with Salesforce, enhancing service and marketing efforts.

Centralized rent payments: manage recurring rent payments, tenant data, and service requests all in one place, improving efficiency across departments.

On-time, every time: automate rent payments and avoid late fees, ensuring tenants stay happy and your operations run smoothly.

Flexible payment methods: tenants can pay via cards, Direct Debits, or bank transfers, providing flexibility and convenience.

Service-linked payments: sync payments with tenant service requests to streamline operations across your teams.

FinDock: your last technology choice for Payments

FinDock is natively built within Salesforce, meaning your payment data is fully integrated into your CRM. No more juggling multiple systems or dealing with fragmented payment processes. FinDock is your final technology decision when it comes to payments. Why?

One platform for all payments

Whether it’s online or offline, one-time or recurring, FinDock handles it all within Salesforce. No more switching between platforms.

Easily add new payment methods

As new payment methods emerge, you can simply “Dock it in.” With FinDock, future payment options are no longer a challenge, they’re an opportunity.

Customers pay their way

Your customers can pay using any preferred method, giving them the flexibility they expect, while you enjoy seamless integration within Salesforce.

Effortless payment

integration and

optimisation in Salesforce

FinDock seamlessly integrates global and local payment providers into Salesforce, letting you manage payments, toggle methods, and gain real-time insights. All within your CRM.

Take a look at our factsheet to discover all supported payment methods and processors.

FinDock + Salesforce

= Happiness

Placing payments in your CRM creates a ripple effect throughout your entire organisation. Here’s how:

Work more efficiently: By centralising payment processes in Salesforce, your team reduces manual tasks, speeding up operations across the board.

Be more effective: With real-time payment data, your teams can respond faster to customer needs, resolve payment issues more quickly, and improve overall service.

Increase customer loyalty: By offering personalized, frictionless payment experiences, you create happier customers who stay loyal longer.

Drive more revenue: Payments become an integral part of your customer interactions, offering opportunities for upselling, cross-selling, and improved retention.

Boost ROI: With streamlined operations, higher customer satisfaction, and better data insights, FinDock helps you achieve a higher return on your Salesforce investment.

Ready for Customer Payment Happiness?

FinDock is trusted by over 300 organisations worldwide, processing over 100 million transactions annually and managing $3 billion in revenue. With a 4.98-star rating on the Salesforce AppExchange, we are the #1 Customer Payment Management solution on Salesforce. That’s why we sometimes end up with an award in hand.