1. New Pilot: Swish for FinDock

FinDock is introducing a seamless integration with Swish, a mobile payment system in Sweden. Swish is recognized for its popularity among the 94% of Swedes who use it at least once a month for a variety of transactions. These transactions range from peer-to-peer fund transfers and covering everyday expenses like lunch, to making one-time payments or donations to businesses and churches. The core of Swish’s success lies in its use of mobile technology, enabling fast, secure, and seamless financial transactions. By linking their bank account to a mobile phone number, users can instantly send and receive money.

As a technical partner of Swish, FinDock has enhanced its platform to enable users to initiate Swish payments using the FinDock API. In addition, the integration automates the reconciliation process within Salesforce for completed Swish payments.

Watch the demo video from our release webinar to see how Swish for FinDock works.

2. New Pilot: FinDock e-mandates

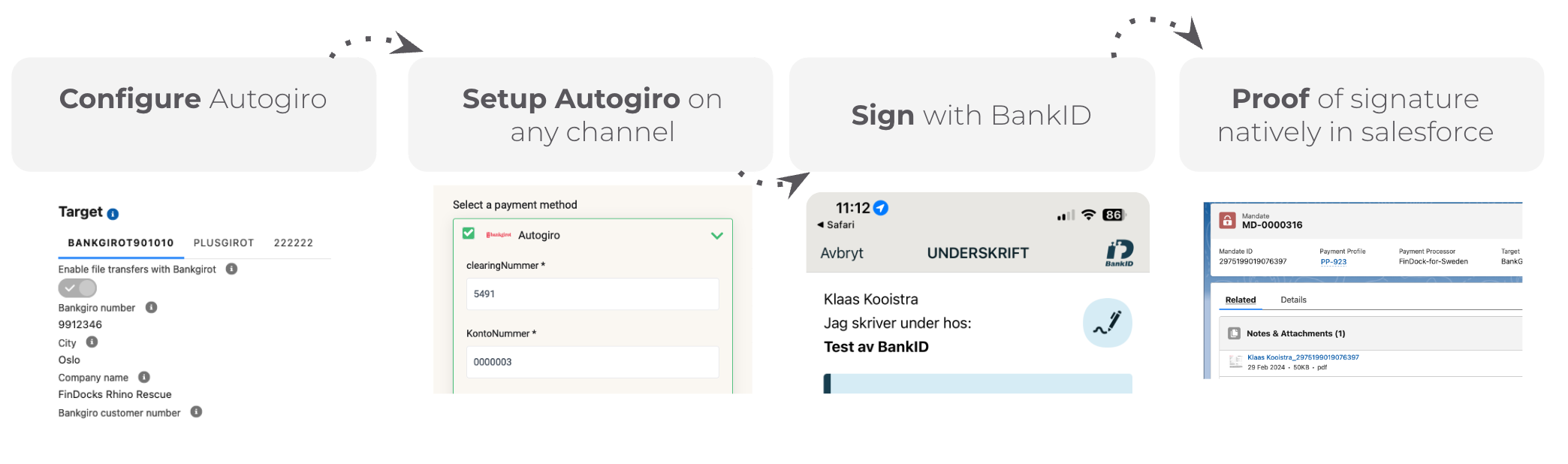

A totally new feature we are launching in this release is FinDock e-mandates. The need for e-mandates comes from the transition from traditional paper-based methods to more streamlined, digital solutions in direct debit systems. In many cases, collecting funds directly from a customer’s bank account required a physical signature, leading to a cumbersome process filled with paperwork. However, the evolution of digital banking has seen a shift towards digital consent methods, especially in Nordic countries.

With our FinDock e-Mandates feature, the need for physical signatures is eliminated, allowing customers to provide digital consent quickly and securely, using a method they are already familiar with and trust, such as a government-issued digital ID. This digital approach not only simplifies the process, but also increases conversion rates, as customers can authenticate via familiar, trusted methods on their digital devices. In addition, storing these digital signatures in Salesforce eliminates the need for physical paperwork, centralizing the data in Salesforce.

For Autogiro direct debits specifically, this means users can authenticate via BankID, ensuring secure identity confirmation and generating a digitally signed mandate PDF stored directly in Salesforce, streamlining the payment initiation and authorization process. FinDock e-mandates, just like the rest of FinDock offerings, is fully Salesforce native.

Watch the demo video from our release webinar to see how FinDock e-mandates work.

3. Nonprofit Cloud full feature parity with the Nonprofit Success Pack and other updates

We embarked on a journey with Salesforce to ensure that all FinDock for NPSP features are seamlessly integrated with the new fundraising modules developed for Salesforce’s Nonprofit Cloud. We are pleased to announce that we have achieved full feature parity, meaning that all FinDock features are now enabled and fully compatible with the new Nonprofit Cloud.

- Support for the Payment Request Generator linkdocs

It also includes the capability to generate payment references on outreach source codes. - Support for Quick Tikkie component linkdocs

It now supports person accounts, allowing the component to be used on Fundraising objects such as Gift Transaction. - Support for GoCardless Quick Direct Debit linkdocs

The GoCardless Quick Direct Debit component, used for manually entering GoCardless direct debit payments, can now be used with FinDock for Fundraising. - Bacs Bank Account Checker linkdocs

The FinDock sort code and account checking for Bacs Direct Debit can be added to Fundraising objects including Gift Commitment, Gift Commitment Schedule and Gift Transaction.

4. New Pilot: FinDock MOTO for Worldpay

With this release, we are excited to introduce a pilot that allows you to accept MOTO payments directly from Salesforce using Worldpay as the processor. Although this was already possible with Stripe, we are excited to introduce another processor compatible with MOTO payments.

With FinDock’s Virtual Terminal (MOTO), organizations can easily process card payments over the phone, from offline forms, or from “cards on file” in a secure Salesforce environment. By bringing offline, online and MOTO payments together in Salesforce, our native payments on Salesforce solution enables you to enrich reports and dashboards, trigger journeys or flows, and access a comprehensive view of all customer payments.

We’re actively looking for pilot customers for this feature, so if you use Worldpay or are thinking about using Worldpay, and you would like to do MOTO payments from Salesforce, please send us an email.

You can find the full and detailed list of all the new features, improvements and bug fixes in our release notes.

FinDock Factsheet – March 2024

All you need to know about FinDock’s features in one handy PDF. Download it, share it, but always make sure to check back for the latest version. We release new features often.